Basic Philosophy on Corporate Governance

The Onoken Group responds with speed and precision to sudden changes in the business environment and strives to consistently create new value with the aim of improving our business performance. In tandem with these initiatives, we will accelerate making improvements to our internal management systems and boost transparency in management through legal compliance, respect for shareholders, and full information disclosure.

Overview and Reason for Adopting the Corporate Governance System

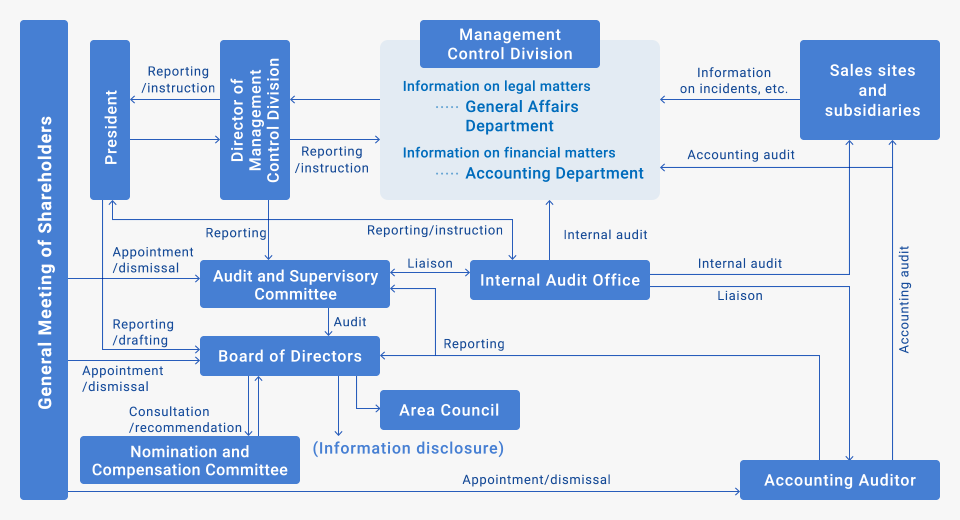

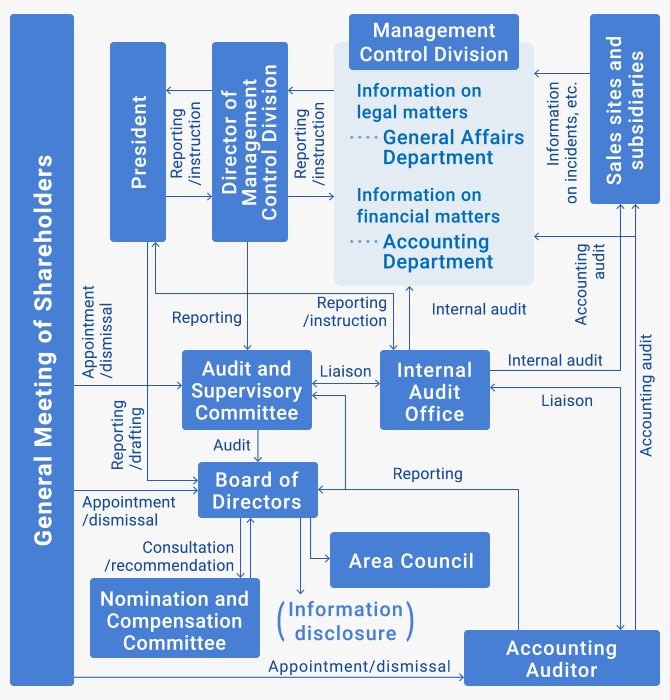

The Board of Directors, Audit and Supervisory Committee, and Accounting Auditor were established as the main deliberative bodies of the Company, while the Internal Audit Office and segment area (block) meetings were established as complementary bodies. The Internal Audit Office audits every sales office and Group company. Segment area meetings are held as necessary as a way to exchange information.

The aim of this system is to reinforce corporate governance by strengthening the oversight of the Board of Directors. We believe that the Internal Audit Office will lead to better supervision through close ties with each director, who are members of the Audit and Supervisory Committee, and the Accounting Auditor. As well, area council meetings help ensure optimal store operations that leverage distinctive regional characteristics and are based on a sales policy established by the Board of Directors.

Corporate Governance System

Information Management

Financial information and important corporate information are gathered by the Management Control Division, reported to the President via the director of that division, and then made public following approval by the Board of Directors.

All executive officers and employees are informed of important corporate information by a branch manager or subsidiary president only when it is released to the public.

The Audit and Supervisory Committee provides opinions on corporate information to the Board of Directors, which strengthens management oversight. The Internal Audit Office provides advice and makes recommendations on incidents that occur to help optimize internal operations.

Information Disclosure

Guided by the basic principles of fair disclosure, Onoken is committed to disclosing financial information as quickly as possible following the settlement date to improve management transparency and ensure fairness. Our IR activities also make sure that the public is thoroughly informed.

In particular, we hold corporate IR briefings for institutional investors every six months was well as briefings for individual investors, while management responds to all requests for interviews from shareholders. These and other actions contribute to the sustainable growth of the company and an increase in corporate value over the medium to long term. In addition, we disclose our financial information, such as quarterly results, as IR information on our website. We have released financial results online since the fiscal year ended March 2002.

We will regularly update our website, aware of the important role websites play in quickly and continually disclosing information as well as communicating with shareholders and investors.

Further, we will optimize our computer systems for core operations that fully integrate management of the entire company, in this way boosting efficiency, and we will continually improve information management, including for personal information, while ensuring speedy disclosures.

Outside Director

Koichi Fukuda

Outside Director

| Supplementary Explanation of the Relationship | Reasons of Appointment |

|---|---|

| ー | Mr. Koichi Fukuda was elected with the expectation of effectively supervising the execution of the duties of the Board of Directors and for providing well-balanced advice from an expert perspective. He will use his extensive knowledge as a certified public accountant within an increasingly complex business environment. In addition, he fully satisfies the requirements for being an independent director as specified by the Tokyo Stock Exchange and other exchanges. The Company believes that no conflict of interest is likely to arise between Mr. Koichi Fukuda and the Company's general shareholders. |

Tomohiro Yamagami

Outside Director and Audit and Supervisory Committee Member

| Supplementary Explanation of the Relationship | Reasons of Appointment |

|---|---|

| ー | Mr. Tomohiro Yamagami was elected with the expectation of providing advice from a professional legal standpoint, ensuring thorough compliance with laws and regulations, and strengthening management monitoring and auditing in an increasingly complex business environment. In addition, he fully satisfies the requirements for being an independent director as specified by the Tokyo Stock Exchange and other exchanges. The Company believes that no conflict of interest is likely to arise between Mr. Tomohiro Yamagami and the Company's general shareholders. |

Hisakazu Umeda

Outside Director and Audit and Supervisory Committee Member

| Supplementary Explanation of the Relationship | Reasons of Appointment |

|---|---|

| ー | Mr. Hisakazu Umeda was elected with the expectation of effectively supervising the execution of duties of the Board of Directors and of providing well-balanced advice from an expert perspective that makes use of his extensive knowledge as a certified public accountant in an increasingly complex business environment. In addition, he satisfies the requirements for being an independent director as specified by the Tokyo Stock Exchange and other exchanges. The Company believes that no conflict of interest is likely to arise between Mr. Hisakazu Umeda and the Company's general shareholders. |

Tomoko Ogura

Outside Director and Audit and Supervisory Committee Member

| Supplementary Explanation of the Relationship | Reasons of Appointment |

|---|---|

| ー | Mr. Tomoko Ogura was elected with the expectation of providing advice from a professional legal standpoint, ensuring thorough compliance with laws and regulations, and strengthening management monitoring and auditing in an increasingly complex business environment. In addition, she fully satisfies the requirements for being an independent director as specified by the Tokyo Stock Exchange and other exchanges. The Company believes that no conflict of interest is likely to arise between Ms. Tomoko Ogura and the Company's general shareholders. |

Basic Policy on the Internal Control System and Progress on Systems Development

The Company will create an internal control system to ensure that directors and employees fully comply with all laws, regulations, and the Articles of Incorporation in the execution of their duties and that operations are conducted efficiently.

For managing information effectively, all financial information and important corporate information are gathered by the Management Control Division, reported to the president via the director of this division, and then made public following approval from the Board of Directors.

All executive officers and employees are informed of important corporate information by a branch manager or subsidiary president only when it is released to the public.

The Audit and Supervisory Committee provides opinions on corporate information to the Board of Directors, which strengthens management oversight. The Internal Audit Office provides advice and makes recommendations on incidents that occur to help optimize internal operations.

Basic Policy on Helping to Eliminate Antisocial Forces and the Status of Improvements

The Company takes a hard stand against antisocial forces and will never enter into a relationship with any antisocial factions or groups to be both socially responsible and to protect the corporation. The Company will also work closely with outside expert organizations, such as the police, when approached by antisocial forces.

In addition, we have established a compliance manual for all employees and executive officers both inside and outside the Company, and we conduct training on compliance when it is necessary.